Contracts are financial instruments that allow users to speculate on the movement of asset prices at a future date at a price agreed at the time of contracting. They can be used for a variety of purposes, such as investment.

Contract types

Binarytools has multiple contracts, all of which have their own characteristics and associated risks, see below for each of them.

Up/Down

Up/Down contracts are divided into two types

Rise/Fall

This contract is executed under the prediction of the price of a market asset, where the exit or sale price of the contract culminates above or below a price within a stipulated period.

These contracts offer a duration per trade ranging from 1 tick to days, depending on the choice.

Payouts range from 85% to 95% of the investment.

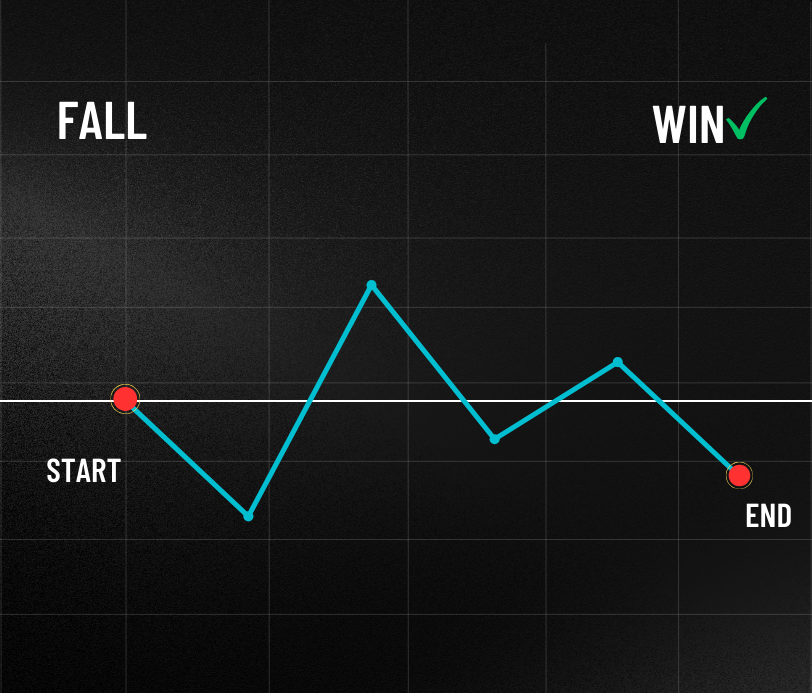

Selecting “Rise” will win the trade if the exit point is higher than the entry point.

Selecting “Fall” will win the trade if the exit point is lower than the entry point.

Higher/Lower

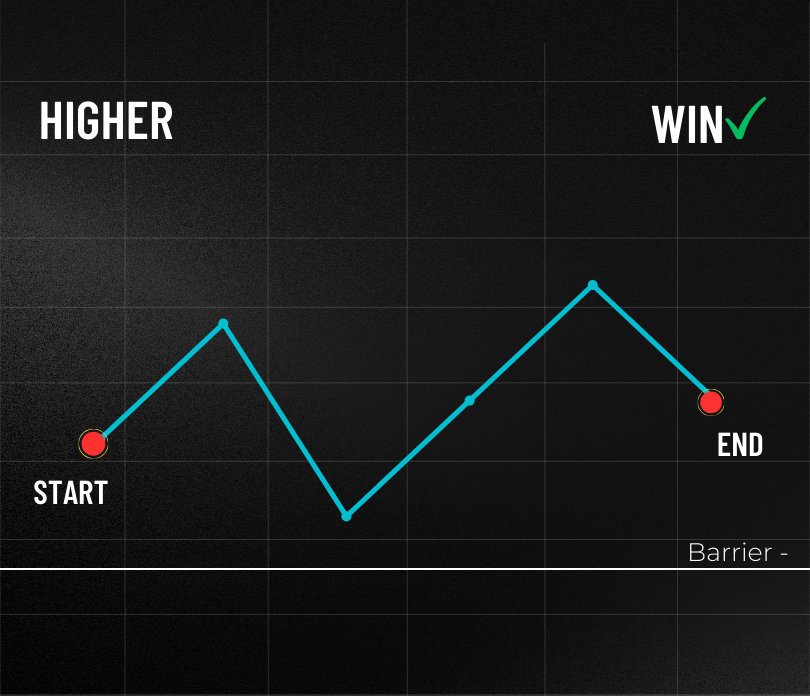

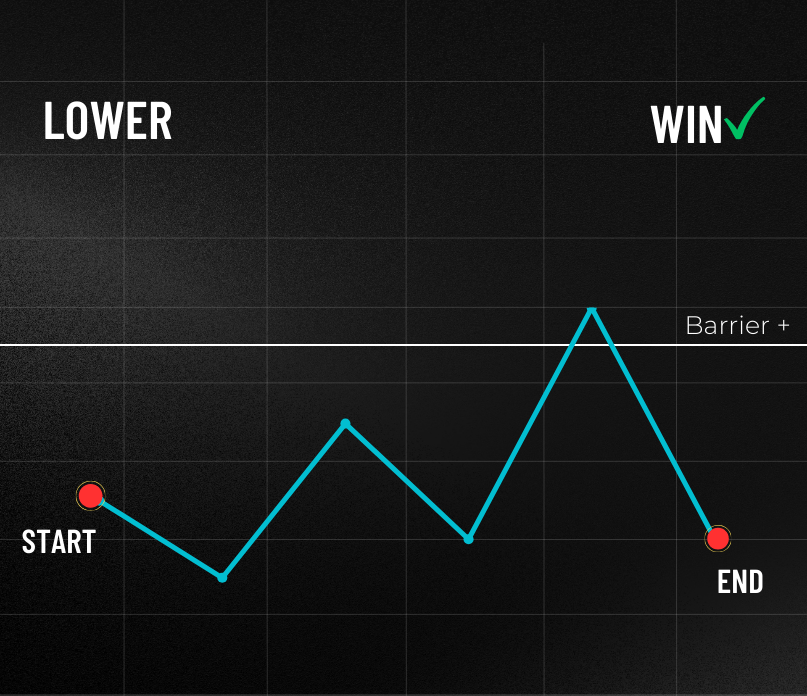

This contract is similar to Rise/Fall. The difference lies in its so-called barrier. Before buying a contract, a price barrier is set. In the same way, a market prediction is made as to whether the price of the asset will be above or below the barrier.

These contracts offer a duration per trade ranging from 5 ticks to days, depending on the choice.

This contract has only one barrier, which can be positive or negative.

To position a barrier at the top of the asset price, it must be positive. To position a barrier at the bottom of the asset price, it must be negative.

If you select “Higher” you will win the trade if the exit point is higher than the price set in the barrier.

If you select “Lower” you will win the trade if the exit point is lower than the price set in the barrier.

Up/Down Equals

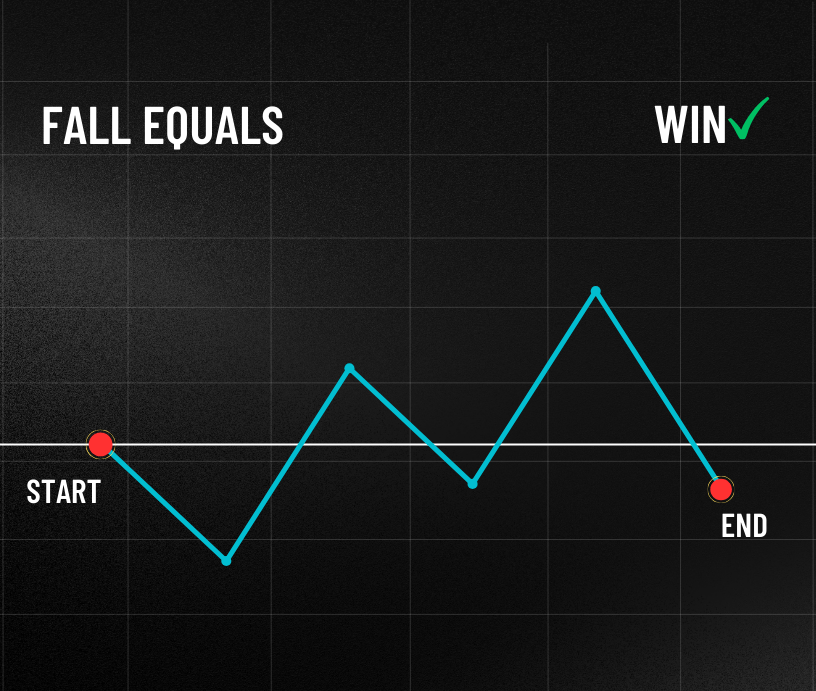

This contract predicts the market, where, if the exit price of the contract ends up above or below in a stipulated period, with the characteristic that the exit price of the contract can be equal to the entry price.

These contracts offer a duration per trade ranging from 1 tick to days, depending on the choice.

Payouts range from 85% to 95% of the investment.

Selecting “Rise Equals” will win the trade if the exit point is greater than or equal to the entry price.

Selecting “Fall Equals” will win the trade if the exit point is less than or equal to the entry price.

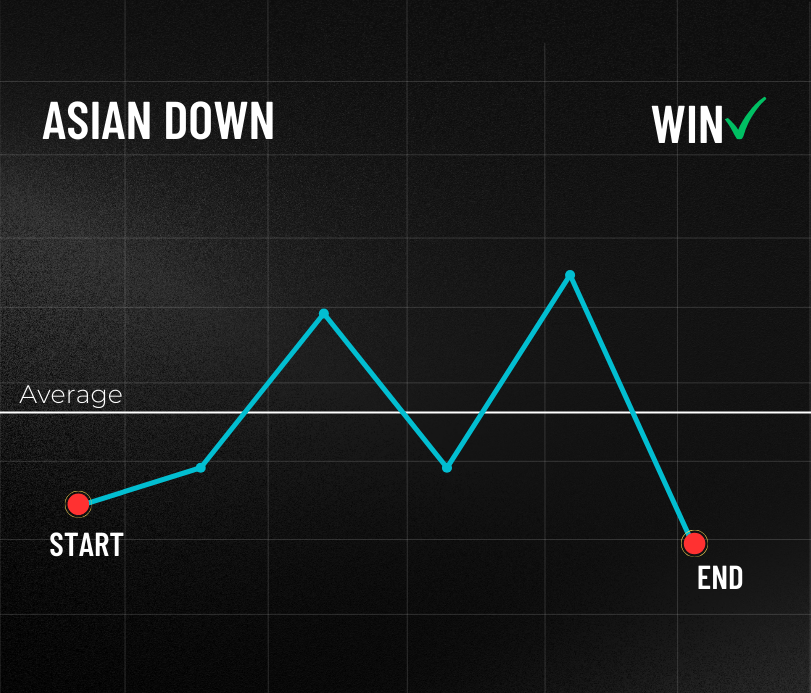

Asians

The contract initially calculates the average of an asset over the duration of the trade, operating under the prediction of the final price (last tick) whether it will be higher or lower than the average price.

These contracts only offer a trade duration of 5 ticks to 10 ticks.

Payouts range from 85% to 92% of the investment.

If you select “Asian Up” you will win the trade if the exit point is above the average ticks.

Selecting “Asian Down” will win the trade if the exit point is below the average ticks.

You can be interesting in: “Trading Manual on BINARYTOOLS.IO“

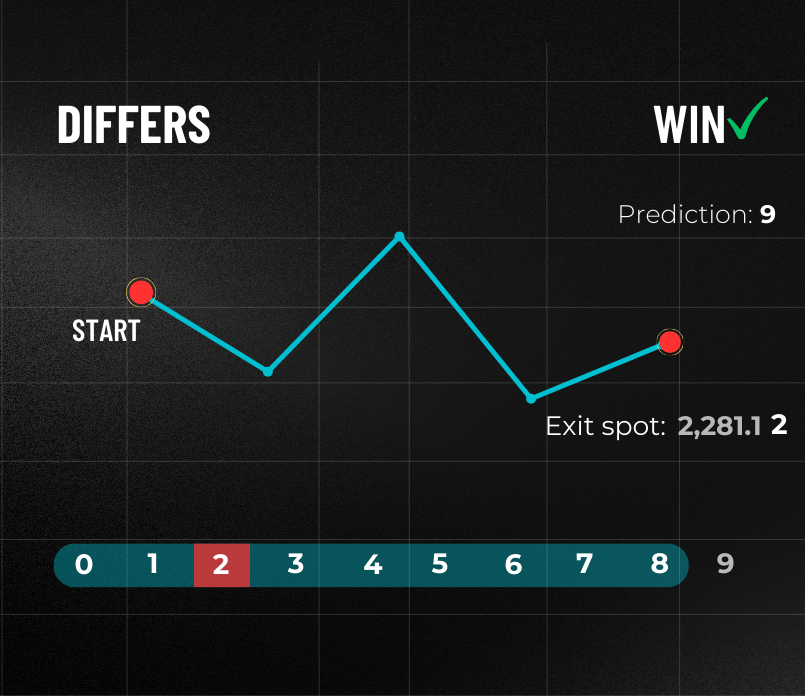

Digits

Digit contracts are executed based on the prediction of the last tick value. If the last tick value meets the condition specific to each contract type, the contract is executed. Digit contracts are divided into three types.

Matches/Differs

The contract is executed under the prediction of whether the last digit will be equal to or different from the selected number.

Such a contract only offers a duration per trade from 1 to 10 ticks.

The payouts for this type of contracts are very diverse due to the probability rate of the outcome.

If you select “Matches” you will win the trade if the last ticks is equal to the digit selected for the prediction.

If you select “Differs” you will win the trade if the last ticks is different from the digit selected for the prediction.

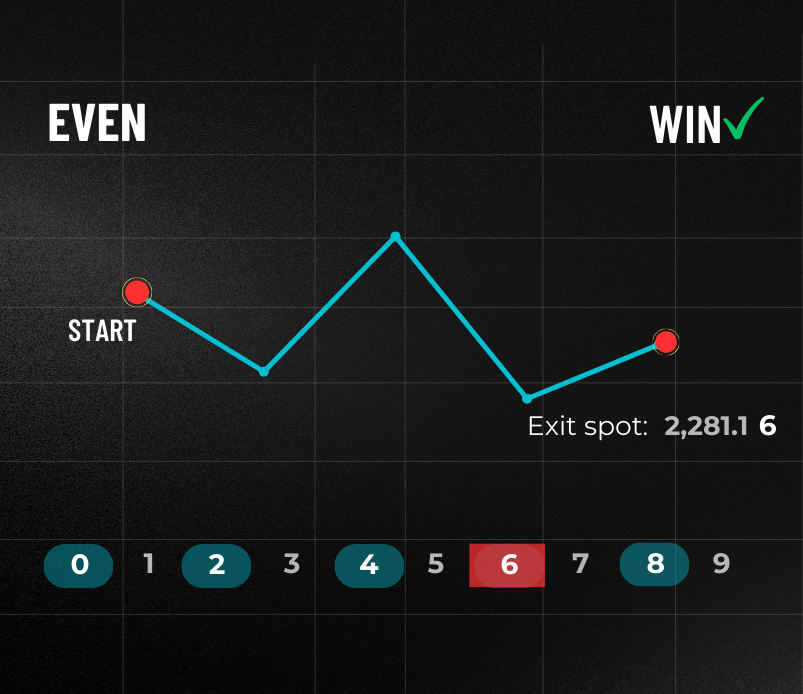

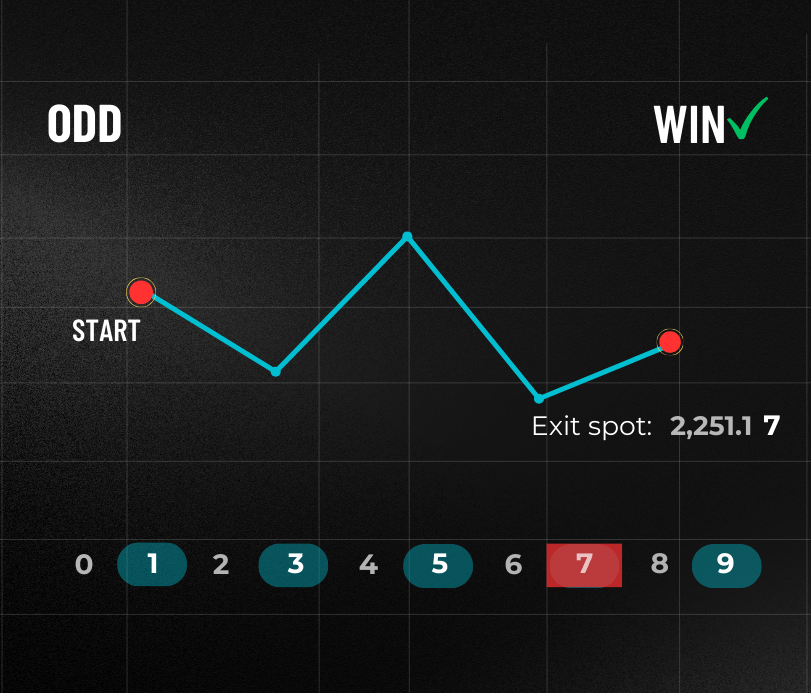

Even/Odd

The prediction of whether the last digit of the price will be an odd or even number is the basis for its execution.

Payouts range from 85% to 92% of the investment.

This contract only offers a trade duration of 1 tick to 10 ticks.

If you select “Even” you will win the trade if the last tick is an even number.

Selecting “Odd” will win the trade if the last ticks is an odd number.

Over/Under

It is executed under the prediction of the last digit of the price will be above or below a given number.

Like the Matches/Differs contract, they are based on the same probability criteria for payouts to be made.

This contract only offers a duration per trade of 1 tick to 10 ticks.

If you select “Over” you will win the trade if the last ticks is greater than the one selected for the prediction.

If you select “Under” you will win the trade if the last ticks is less than the one selected for the prediction.

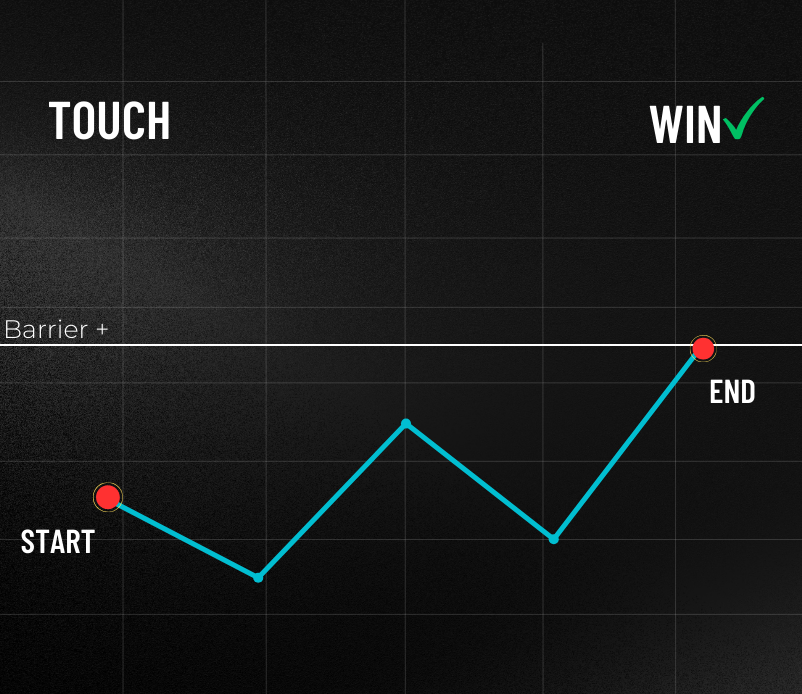

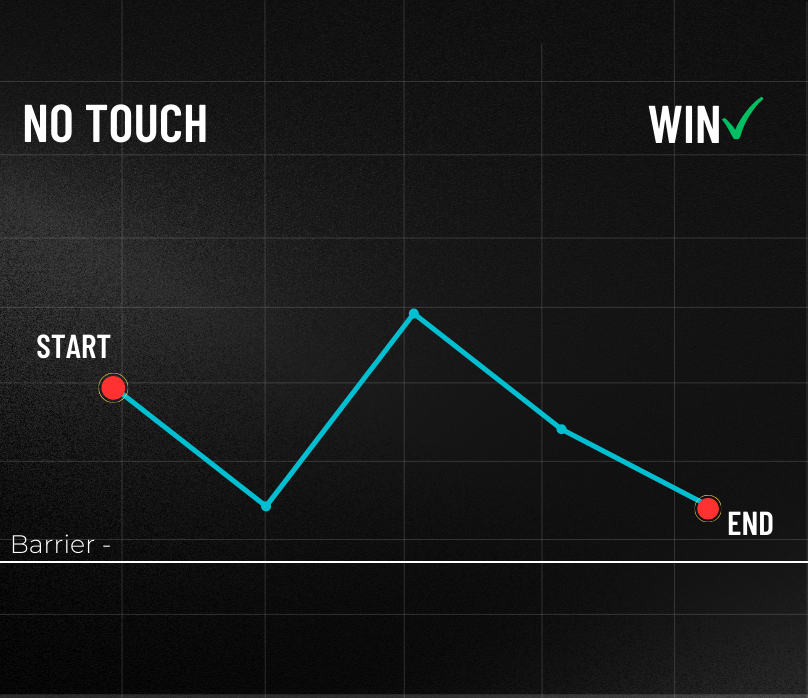

Touch /No Touch

Touch/No Touch contracts are made by predicting whether the market will or will not touch a target called a barrier during the time period in which they are purchased.

The payouts for this type of contract are very diverse due to the barrier selected.

This contract has only one barrier, which can be positive or negative.

To position a barrier on top of the asset price, it must be positive. To position a barrier at the bottom of the asset price, it must be negative.

If you select “Touch”, you will win the trade if the asset price touches the given barrier within the contract period.

If you select “No Touch”, you will win the trade if the asset price does not touch the given barrier within the contract period.

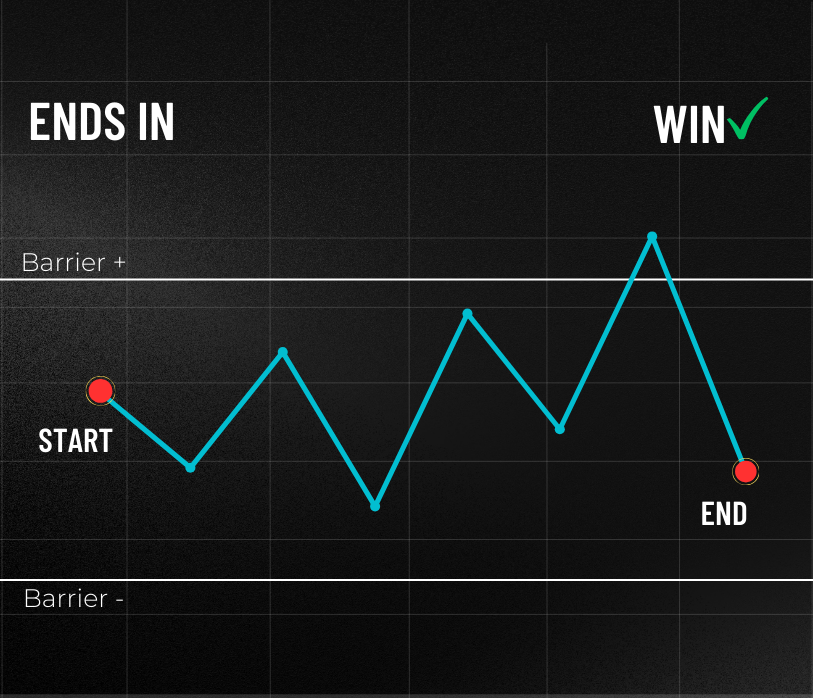

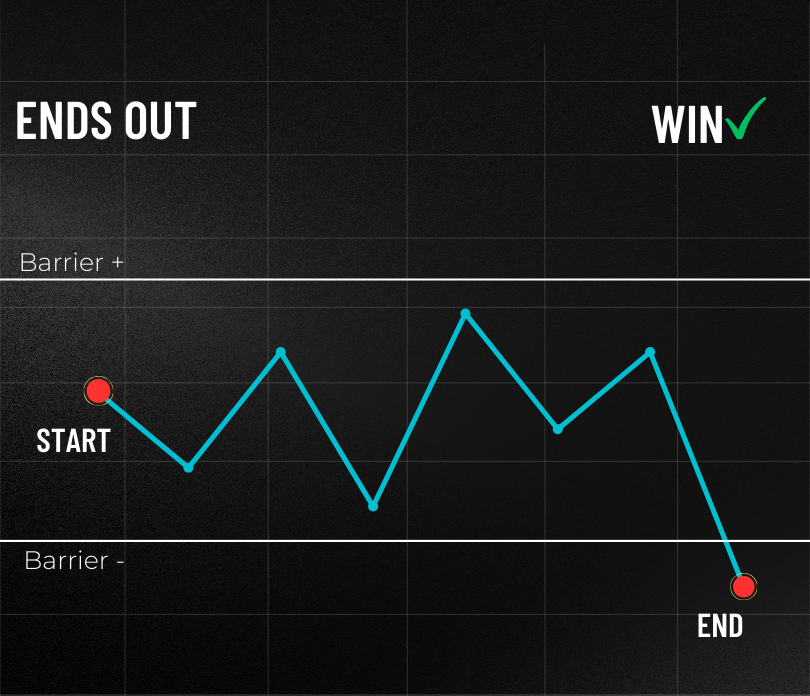

Ends In/Out

The Ends In/Out contract allows you to determine whether the price of a market asset ends up inside or outside predetermined barriers during the term of the purchased contract.

The returns for this type of contract are based on various conditions, such as barrier levels, trade duration and market conditions.

These contracts offer a duration per trade ranging from 2 minutes to days.

Such a contract has two barriers, the first of which is positive (+) and the second is negative (-).

(-).

To position the barrier at the top of the asset price, it must be positive. To position the barrier at the bottom of the asset price, it must be negative.

If you select “Ends In”, you will win the trade if the asset price at the end of the trade is within the upper barrier and the lower barrier.

If you select “Ends Out”, you will win the trade if the asset price at the end of the trade is outside the upper barrier or outside the lower barrier.

You can be interesting in: ¡Llegó el trading Manual, a BinaryTools!

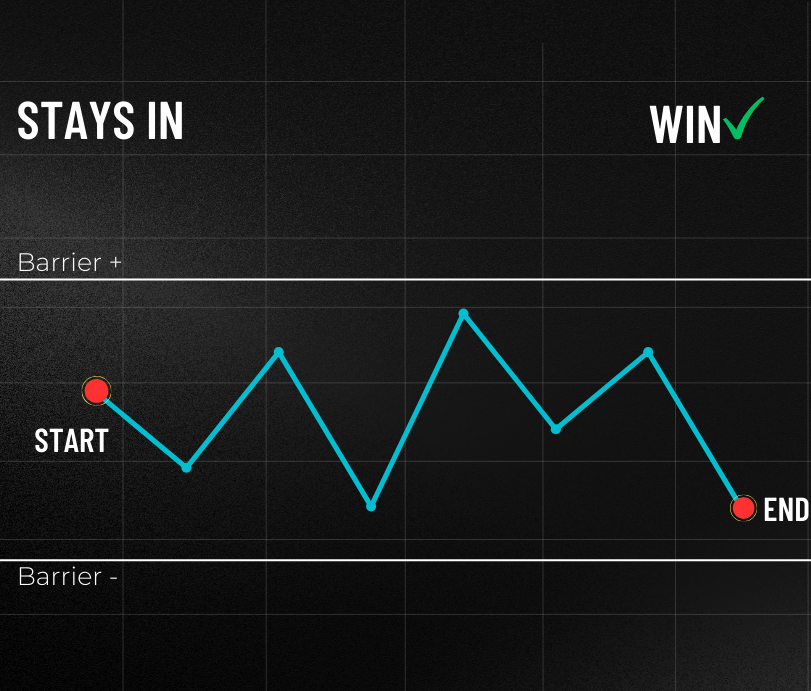

Stays In/Goes Out

The Stays In/Goes Out contract allows you to determine whether the price of a market asset remains inside or outside predetermined barriers during the term of the purchased contract.

The returns for this type of contract are similar to the Ends In/Out contract because their payout is based on the same conditions.

These contracts offer a duration per trade ranging from 2 minutes to days.

This contract has two barriers, the first of which is positive (+) and the second is negative (-).

(-).

To position the barrier on top of the asset price, it must be positive. To position the barrier at the bottom of the asset price, it must be negative.

If you select “Stays In” you will win the trade if the asset price stays between the upper barrier and the lower barrier (without touching them) in the period of the purchased contract.

If you select “Goes Out” you will win the trade if the asset price touches or exits the upper and lower barriers in the period of the purchased contract.

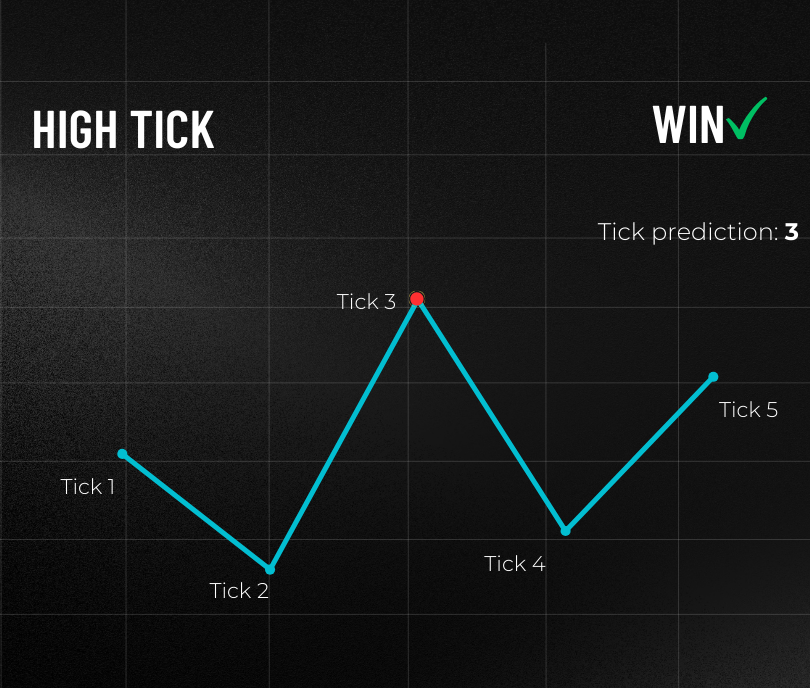

High/Low Ticks

To trade the High/Low Ticks contract, you are required to predict what the highest or lowest ticks will be during the selected period.

These contracts only offer a duration of 5 ticks.

The returns for this type of contract tend to be high due to the low probability of assertiveness.

If you select “High Tick” you will win the trade if the selected ticks is the highest of the following ticks.

Selecting “Low Tick” will win the trade if the selected ticks is the lowest of the following ticks.

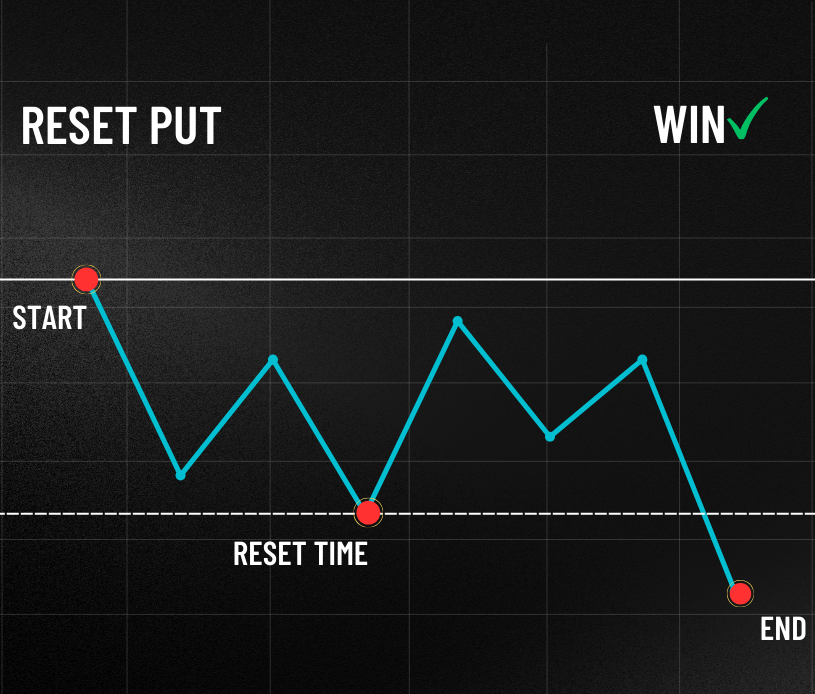

Reset Call/Reset Pull

Trading the Reset Call/Reset Pull contract requires predicting whether the exit price will be higher or lower than the entry price or the reset price.

higher or lower than the entry price or the reset price. The reset price is taken in the middle

of the purchased contract

These contracts offer a duration per trade ranging from: 5 ticks, seconds minutes and 2 hours.

hours.

If you select “Reset Call” you will win the trade if the exit point is higher than the entry point or reset price.

Selecting “Reset Put” will win the trade if the exit point is lower than the entry point or reset price.

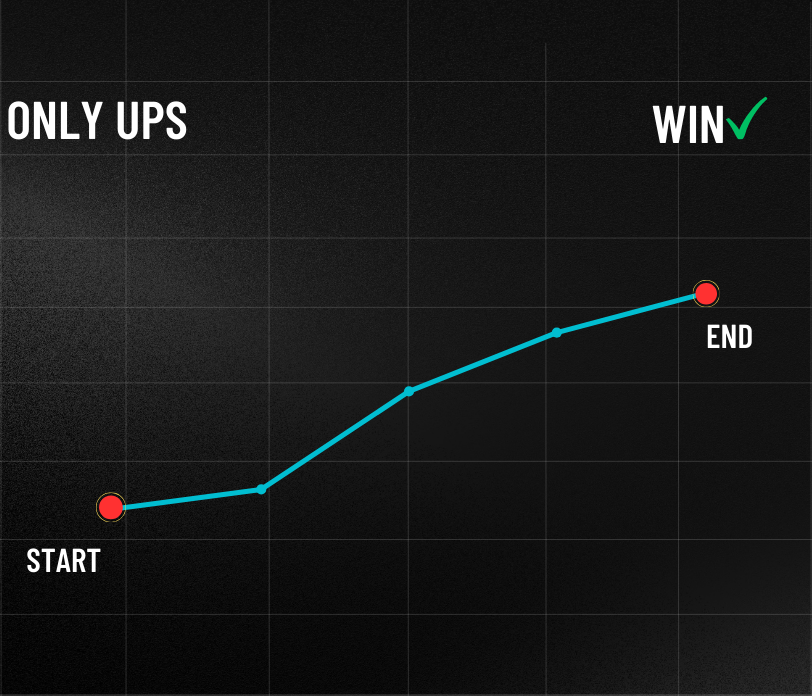

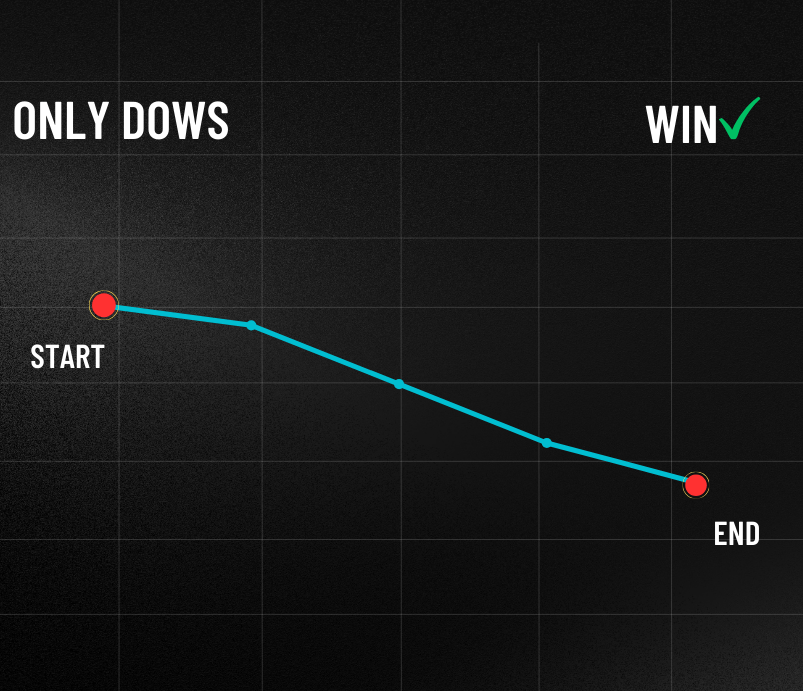

Only Ups/Only Downs

Trading the Only Ups/Only Downs contract requires predicting whether ticks will go down or up after the entry point.

will go up successively after the entry point.

These contracts only offer a duration of 2 to 5 ticks.

Returns for this type tend to be high due to the low probability of assertiveness.

If you select “Only Ups” you will win the trade if the ticks go up successively after the entry point.

If you select “Only Dows” you will win the trade if the ticks go down successively after the entry point.

Allí this and more you can find on Binarytools, The Neuronaltrader team keep working hard for you And If you are part of our community and use Binarytools to automatized your strategy. Let us know what do you think about this version. Come into the community and know what others user are talking about Binarytools.

what are you waiting for? Join here!

Important: The information and/or knowledge expressed in this article shouldn’t be taken as investment recommendations or financial advice. All investments and/or actions involve a risk and each person is responsible for researching, educating and analyzing before making an investment decision.