At this time, we want to introduce you to a cutting-edge bot known as Beyond Bot. This bot is designed to carry out trading activities specifically utilizing the Rise/Fall contract.

The functionality of Beyond Bot is further enhanced through the incorporation of our newest indicator, the Williams %R. This indicator, when utilized in conjunction with the bot, aims to provide an added layer of insight and analysis into market conditions.

With these advanced features, users can expect heightened precision and effectiveness in their trading endeavors.

The utilization of the Williams %R indicator within Beyond Bot reaffirms our commitment to providing traders with innovative tools that leverage the latest advancements in trading technology.

Risk management

Risk management is a critical aspect of any successful trading strategy. The Smart Risk Library is enhanced with the addition of a new block that incorporates advanced Money Management features.

This includes the integration of the Martingale Factor with a value of 2.1, which can help in optimizing risk-reward ratios and managing potential losses more effectively.

Additionally, the library now includes Compound Level 1, offering traders the ability to intelligently reinvest profits to potentially amplify returns while carefully controlling risk.

By leveraging these powerful risk management tools, traders can enhance their overall risk management approach and strive for more consistent and sustainable trading performance.

- Initial Stake: 0.35$.

- Stop Loss: 100$.

- Take profit: 5$.

- Virtual Mode: Win

- Tolerance and Negative Streak activated.

Indicators

- Williams % R

- Candle Colors

If you want to know more about the Williams % R indicator, please visit: Williams %R indicator in binary Trading!

BOT trading strategy

The Beyond Bot will perform Rise/Fall contract purchase trades in a 1 minute period of time, they will be executed under the following strategy:

Candle colors library is analyzing the color of the last two candles.

This bot can operate in Reversal or Continuity mode.

- Reversal:

RISE: Two red candles and the Williams % R from -100 to -70.

FALL: Two green candles and the Williams % R from -30 to 0.

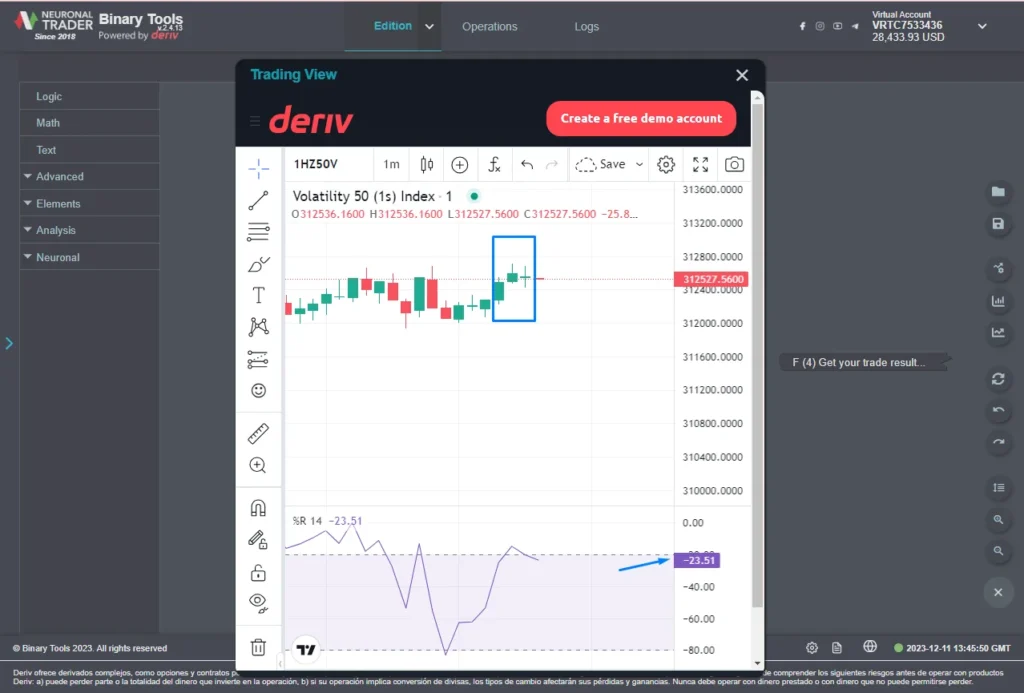

This example shows two consecutive green candlesticks and the Williams % R indicator with a value of -23. Which the bot would execute buy trades type Fall.

- Continuity:

FALL: two red candles and the Williams % R from -100 to -70.

RISE: two green candles and the Williams % R from -30 to 0.

This example shows two consecutive Red candlesticks and the Williams % R indicator with a value of -86, which the bot would execute a buy trade type Fall.

Have you not yet used the Beyond Bot? Go and download here… What are you waiting for?

Consider the following guidelines that can assist you in refining your analysis and enhancing your trading operations.

When executing a trading operation, it is crucial to ensure that it is carried out on a healthy chart. This involves identifying charts with candlesticks that exhibit substantial body and clearly defined trends. Providing a solid foundation for informed decision-making.

Furthermore, it is essential to emphasize the importance of independently making trading decisions, conducting thorough analysis. And customizing bot values to align with your unique trading plan and risk management strategy.

This level of personalization and autonomy empowers traders to tailor their approach to the market based on their specific preferences, risk tolerance, and market insights, ultimately contributing to a more refined and effective trading strategy.

Furthermore, it is crucial to understand that the financial markets are inherently unpredictable, and no trading strategy can provide an absolute guarantee of success.

Even the most carefully crafted trading approach may encounter unexpected challenges and market conditions that can lead to losses. Therefore, it is vital for traders to exercise caution and prudence when implementing any trading strategy.

In summary, while the development and implementation of a trading strategy is an essential aspect of active trading, it is imperative to recognize that no strategy is infallible.

Thorough testing, robust risk management, emotional discipline, adaptability, and continuous learning are key elements for navigating the dynamic and unpredictable nature of financial markets.

By approaching trading with a well-informed and prudent mindset, traders can enhance their ability to effectively navigate the challenges and opportunities presented by the markets.

Now you can execute operations manually: Trading Manual arrived to BinaryTools!

Your opinion is important

As a brand, our mission is to innovate and bring quality products to our community, and all of us at Neuronaltrader are working hard to keep adding value to your assets!

If you are part of our community and use Binarytools to automate your strategy, let us know if you have a particular strategy you would like to share, join us here!

Important: The information and/or knowledge expressed in this article shouldn’t be taken as investment recommendations or financial advice. All investments and/or actions involve a risk and each person is responsible for researching, educating and analyzing before making an investment decision.